Wise vs PayPal vs Payoneer: Best Payment Method for Filipino Freelancers (2025)

Compare Wise, PayPal, and Payoneer fees for Filipino freelancers. Real calculations, GCash integration, and which platform saves you the most money in 2025.

Getting paid shouldn't cost you 5% of your hard-earned income. Yet thousands of Filipino freelancers lose tens of thousands of pesos every year simply because they picked the wrong payment platform.

With approximately 1.5 million Filipinos now offering services on international platforms, choosing between Wise vs PayPal vs Payoneer in the Philippines has become one of the most important financial decisions you'll make as a freelancer. The difference between platforms can mean keeping an extra ₱30,000 or more per year in your pocket.

We'll break down exactly how much each platform really costs, show you real peso amounts (not just percentages), and help you decide which one makes the most sense for your situation. Whether you're a virtual assistant in Cebu, a developer in Davao, or a content writer working from your province, this comparison will help you keep more of what you earn.

Quick verdict: Which should you choose?

Short on time? Here's what you need to know:

Choose Wise if:

- You receive direct payments from clients (not through Upwork/Fiverr)

- Exchange rate matters most to you

- You want the fastest withdrawals via InstaPay

Choose Payoneer if:

- You work on Upwork, Fiverr, or Toptal

- You want a USD debit card

- You receive payments from other Payoneer users (free transfers)

Choose PayPal if:

- Your client insists on using PayPal

- You need buyer/seller protection for e-commerce

- You prefer instant GCash withdrawals

The bottom line: Wise offers the best exchange rates, Payoneer has the best platform integrations, and PayPal has the widest acceptance. Keep reading for the complete breakdown with real numbers.

How we compared these platforms

Before diving into each platform, here's what we evaluated:

- Exchange rates: Does the platform use the real mid-market rate, or do they add a hidden markup?

- Transfer fees: Both fixed fees and percentage-based charges

- Withdrawal speed: How fast can you get money into BPI, BDO, UnionBank, or GCash?

- Local integration: Support for InstaPay, PESONet, GCash, and Maya

- Platform compatibility: Direct connections to Upwork, Fiverr, and other freelance marketplaces

All fees were verified in December 2025 from official pricing pages. Exchange rates fluctuate daily, so we've used example calculations to show the real-world impact.

Wise: Best for exchange rates

If maximizing every peso matters to you, Wise (formerly TransferWise) is hard to beat. Unlike PayPal and Payoneer, Wise uses the real mid-market exchange rate—the same rate you see on Google—with no hidden markup.

How Wise works for Filipino freelancers

When you sign up for Wise, you get access to multi-currency account details. This means you can receive payments like a local in several countries:

- USD account details: Receive from US clients as if you have a US bank account

- EUR account details: Accept euro payments from European clients

- GBP account details: Get paid in pounds from UK clients

Your money sits in your Wise account until you're ready to convert and withdraw. When you do convert, you get the mid-market rate plus a small, transparent fee.

For withdrawing to Philippine banks, Wise supports:

- InstaPay: Instant transfers to BPI, BDO, UnionBank, and other InstaPay-enabled banks

- PESONet: Same-day transfers for larger amounts

Wise fees breakdown

Here's what you'll actually pay with Wise:

| Service | Fee |

|---|---|

| Account registration | FREE |

| Receiving USD (local bank details) | FREE |

| Receiving USD via SWIFT/wire | $6.11 fixed |

| Currency conversion | From 0.57% |

| Wise debit card | ₱369.60 one-time |

| ATM withdrawals | 2 free/month up to ₱12,000 |

Real example: Receiving $1,000 USD

Say you receive $1,000 from a US client and want to convert it to PHP:

- Conversion fee: ~$5.70 (0.57%)

- Exchange rate markup: $0 (mid-market rate used)

- Total cost: ~$5.70

- You receive: ~$994.30 worth of PHP

At a ₱56 exchange rate, that's roughly ₱55,680 in your Philippine bank account.

Wise pros and cons

Pros:

- Lowest overall fees for currency conversion

- Real mid-market exchange rate (no hidden markup)

- Instant withdrawals via InstaPay

- Multi-currency account with 40+ currencies

- Transparent—you see the exact fee before confirming

Cons:

- No direct integration with Upwork or Fiverr

- Stricter verification process (may take a few days)

- Can't receive payments directly from freelance platforms

Best for

Wise is ideal if you:

- Get paid directly by clients via bank transfer or invoice

- Want to maximize your exchange rate

- Prefer instant withdrawals to your BPI, BDO, or UnionBank account

- Hold multiple currencies and convert when rates are favorable

PayPal: Most widely accepted

PayPal is the payment platform everyone knows. Almost every international client has a PayPal account, making it the easiest option to set up—but that convenience comes at a cost.

How PayPal works for Filipino freelancers

Setting up PayPal in the Philippines is straightforward. You can:

- Receive payments from clients worldwide

- Withdraw to your linked bank account (BPI, BDO, etc.)

- Send money directly to GCash or Maya

- Shop online at stores that accept PayPal

The catch? PayPal's fees are higher than they appear. While the transfer itself might seem cheap, the exchange rate markup quietly takes 3-4% of your money.

PayPal fees breakdown

Here's what PayPal actually charges:

| Service | Fee |

|---|---|

| Receiving international payments | 4.4% + fixed fee |

| Receiving domestic payments | 3.4% + ₱15 |

| Currency conversion markup | 3-4% above mid-market |

| Withdrawal to bank (₱7,000+) | FREE |

| Withdrawal to bank (under ₱7,000) | ₱50 |

| Withdrawal to GCash | FREE |

Real example: Receiving $1,000 USD

Here's where it gets expensive:

- Receiving fee: $0 (if sent as personal payment) or ~$44 (if sent as business payment)

- Exchange rate markup: ~$40 (4% hidden in the rate)

- Total cost: $40-84

- You receive: $916-960 worth of PHP

At a ₱56 exchange rate, you're getting ₱51,296-53,760—that's potentially ₱4,000+ less than Wise for the same $1,000.

PayPal pros and cons

Pros:

- Almost every client has PayPal

- Instant withdrawal to GCash

- Buyer/seller protection for disputes

- Easy to use, familiar interface

- No minimum balance requirements

Cons:

- Highest total cost due to exchange rate markup

- 3-5 business days for bank withdrawals

- Account limitations are common (funds get held)

- Poor exchange rate compared to mid-market

Best for

PayPal makes sense if you:

- Have clients who only pay via PayPal

- Need instant access to funds via GCash

- Sell products online and need buyer protection

- Receive small, frequent payments where convenience matters more than fees

Payoneer: Best for freelance platforms

If you work on Upwork, Fiverr, Toptal, or similar platforms, Payoneer is probably your best option—not because it's the cheapest, but because it's directly integrated with these marketplaces.

How Payoneer works for Filipino freelancers

Payoneer gives you receiving accounts in multiple currencies:

- USD receiving account (US bank details)

- EUR receiving account (European bank details)

- GBP receiving account (UK bank details)

The key advantage? Platforms like Upwork and Fiverr can pay you directly into your Payoneer account, often with lower fees than other withdrawal methods.

You can also get a Payoneer Mastercard to spend your balance directly without converting to PHP—useful for online purchases or subscriptions paid in USD.

Payoneer fees breakdown

Payoneer's fee structure is more complex:

| Service | Fee |

|---|---|

| Receiving from Payoneer users | FREE |

| Receiving via receiving accounts | FREE to 1% |

| Currency conversion (in-account) | 0.5% |

| Withdrawal to PH bank (with conversion) | Up to 3% |

| Annual card fee | $29.95 |

| Annual account fee (if <$2,000 received) | $29.95 |

Warning about the dormancy fee: If you receive less than $2,000 in a 12-month period, Payoneer charges a $29.95 annual account fee. This is a gotcha for part-time or new freelancers.

Real example: Receiving $1,000 USD from Upwork

Here's how the fees stack up from Upwork to your BDO account:

- Upwork fee to Payoneer: $0.99

- Payoneer withdrawal fee: Up to $30 (3%)

- Exchange rate markup: Variable (typically 1-2%)

- Total cost: $31-50

- You receive: $950-969 worth of PHP

At ₱56, that's roughly ₱53,200-54,264—better than PayPal but not as good as Wise.

Payoneer pros and cons

Pros:

- Direct integration with Upwork, Fiverr, Toptal, and 2,000+ platforms

- Payoneer Mastercard for direct USD spending

- Free transfers between Payoneer users

- High withdrawal limits ($200,000 daily)

- Available in 190+ countries

Cons:

- Up to 3% withdrawal fee is steep

- $29.95 dormancy fee if you earn less than $2,000/year

- Exchange rate not as good as Wise

- 1-2 business days for bank withdrawals (slower than InstaPay)

Best for

Payoneer is the right choice if you:

- Work primarily on Upwork, Fiverr, or similar platforms

- Want a USD debit card for online purchases

- Receive frequent payments from other Payoneer users

- Earn consistently (to avoid the dormancy fee)

Head-to-head fee comparison

Now for the real numbers. These calculations assume you're receiving USD from international clients and withdrawing to a Philippine peso bank account.

Receiving $500 USD (entry-level freelancer)

| Platform | Fees + Rate Loss | You Receive (PHP) | Monthly Loss vs Best |

|---|---|---|---|

| Wise | ~$2.85 (0.57%) | ~₱27,840 | — |

| PayPal | ~$20 (4% markup) | ~₱26,880 | ₱960 |

| Payoneer | ~$15-25 (3%) | ~₱26,600-27,160 | ₱680-1,240 |

Winner at $500: Wise (saves ₱960-1,240/month vs alternatives)

Receiving $2,000 USD (mid-level freelancer)

| Platform | Fees + Rate Loss | You Receive (PHP) | Monthly Loss vs Best |

|---|---|---|---|

| Wise | ~$11.40 (0.57%) | ~₱111,360 | — |

| PayPal | ~$80 (4% markup) | ~₱107,520 | ₱3,840 |

| Payoneer | ~$60-80 (3%) | ~₱107,520-108,640 | ₱2,720-3,840 |

Winner at $2,000: Wise (saves ₱2,720-3,840/month)

Receiving $5,000+ USD (senior freelancer)

| Platform | Fees + Rate Loss | You Receive (PHP) | Monthly Loss vs Best |

|---|---|---|---|

| Wise | ~$28.50 (0.57%) | ~₱278,400 | — |

| PayPal | ~$200 (4% markup) | ~₱268,800 | ₱9,600 |

| Payoneer | ~$150-175 (3%) | ~₱270,200-271,600 | ₱6,800-8,200 |

Winner at $5,000: Wise (saves ₱6,800-9,600/month)

The annual impact

Here's what these differences mean over a year:

| Monthly Income | Annual Savings (Wise vs PayPal) | Annual Savings (Wise vs Payoneer) |

|---|---|---|

| $500/month | ~₱11,520 | ~₱8,160-14,880 |

| $2,000/month | ~₱46,080 | ~₱32,640-46,080 |

| $5,000/month | ~₱115,200 | ~₱81,600-98,400 |

That's real money. For a freelancer earning $2,000/month, switching from PayPal to Wise is like giving yourself a ₱46,000 bonus every year.

Withdrawal to Philippine banks: Speed comparison

Getting your money quickly matters, especially if you have bills due or an emergency. Here's how each platform performs:

BPI, BDO, UnionBank, and other major banks

| Platform | Method | Speed | Notes |

|---|---|---|---|

| Wise | InstaPay | Instant | Available 24/7, up to ₱50,000 per transaction |

| Wise | PESONet | Same day | For larger amounts |

| PayPal | Bank transfer | 3-5 business days | Can be frustrating if you need funds quickly |

| Payoneer | Bank transfer | 1-2 business days | Faster than PayPal, slower than Wise |

GCash and Maya withdrawal options

| Platform | GCash Support | Speed |

|---|---|---|

| PayPal | Direct withdrawal | Instant |

| Wise | Via InstaPay to linked bank | Instant |

| Payoneer | Direct to GCash | Usually same day |

Pro tip: If instant GCash access is critical, PayPal actually wins here despite its higher fees. But if you can wait a few seconds to transfer from your bank to GCash, Wise + InstaPay is nearly as fast and much cheaper.

Which payment method should you use?

After comparing all these numbers, here's a practical decision framework:

Choose Wise if...

You should use Wise when:

- You receive payments directly from clients (not through platforms)

- You want the best possible exchange rate

- You can provide clients with bank details for wire transfers

- You want instant PHP access via InstaPay

- You're earning $1,000+ monthly and fees add up

Typical Wise user: A virtual assistant with 2-3 direct clients who invoices monthly and wants to maximize every dollar.

Choose PayPal if...

PayPal makes sense when:

- Your client only offers PayPal as a payment option

- You need instant GCash withdrawals

- You sell products online and want buyer protection

- You're just starting out and need the easiest setup

- Convenience matters more than saving a few percent

Typical PayPal user: A freelancer with one long-term client who's been paying via PayPal for years, or an online seller on Etsy/Shopify.

Choose Payoneer if...

Go with Payoneer when:

- You work primarily on Upwork, Fiverr, or Toptal

- You want a USD debit card for direct spending

- You receive payments from other Payoneer users (free!)

- You earn consistently over $2,000/year (to avoid dormancy fees)

- Platform integration matters more than rates

Typical Payoneer user: An Upwork freelancer earning steady income who wants the simplest withdrawal process from the platform.

The multi-platform strategy

Here's what many experienced Filipino freelancers do: use multiple platforms strategically.

- Payoneer for Upwork/Fiverr earnings (best integration)

- Wise for direct client payments (best rates)

- PayPal as backup when clients insist

This way, you optimize for each payment source rather than forcing everything through one imperfect solution.

Pro tips for Filipino freelancers

After talking to dozens of Filipino remote workers, here are the insider tips that can save you even more:

1. Don't convert immediately

All three platforms let you hold USD (or other currencies) in your account. Watch the exchange rate and convert when it's favorable. The peso fluctuates daily—sometimes waiting a few days means an extra ₱500+ on a $1,000 conversion.

2. Set up InstaPay for Wise withdrawals

When you add your Philippine bank to Wise, make sure you choose InstaPay as your withdrawal method. It's free for amounts under ₱50,000 and instant. PESONet works too but takes longer.

3. Avoid Payoneer's dormancy fee

If you're a part-time freelancer who might earn less than $2,000 in a year, be careful with Payoneer. That $29.95 annual fee can wipe out your savings. Consider Wise as your primary platform instead.

4. Keep records for BIR

As a freelancer, you're technically required to pay taxes on your income. Whichever platform you use, download your transaction history regularly. All three platforms provide statements you can use for BIR filing. Don't wait until tax season to scramble for records.

5. Watch out for PayPal account limitations

PayPal is notorious for suddenly limiting accounts, especially for new users or those receiving large payments. Don't keep large balances in PayPal—withdraw to your bank regularly.

6. Consider the Payoneer card for USD expenses

If you pay for international subscriptions (Adobe, Canva Pro, web hosting), the Payoneer Mastercard lets you pay in USD directly without conversion fees. This can save money compared to converting to PHP and paying with a local card.

7. Negotiate payment methods with new clients

When starting with a new client, ask about their payment options. Many are flexible and will accommodate Wise or direct bank transfers if you explain it's more efficient for both parties.

Conclusion

Choosing between Wise, PayPal, and Payoneer isn't about finding the "best" platform—it's about finding the best platform for your situation.

Here's the quick recap:

- Wise wins on exchange rates and speed—best for direct client payments

- Payoneer wins on platform integration—essential for Upwork and Fiverr users

- PayPal wins on acceptance and GCash convenience—best when you have no other choice

For most Filipino freelancers earning $1,000+ monthly, Wise offers the best value if your clients can pay via bank transfer. If you're working through freelance platforms, Payoneer is the practical choice despite higher fees.

The most important thing? Stop leaving money on the table. Whether you're a virtual assistant in Iloilo, a developer in Manila, or a content creator anywhere in the Philippines, every peso you save on fees is a peso you keep.

Ready to put your payment strategy to work? Browse remote job opportunities that pay in USD and start maximizing your freelance income today.

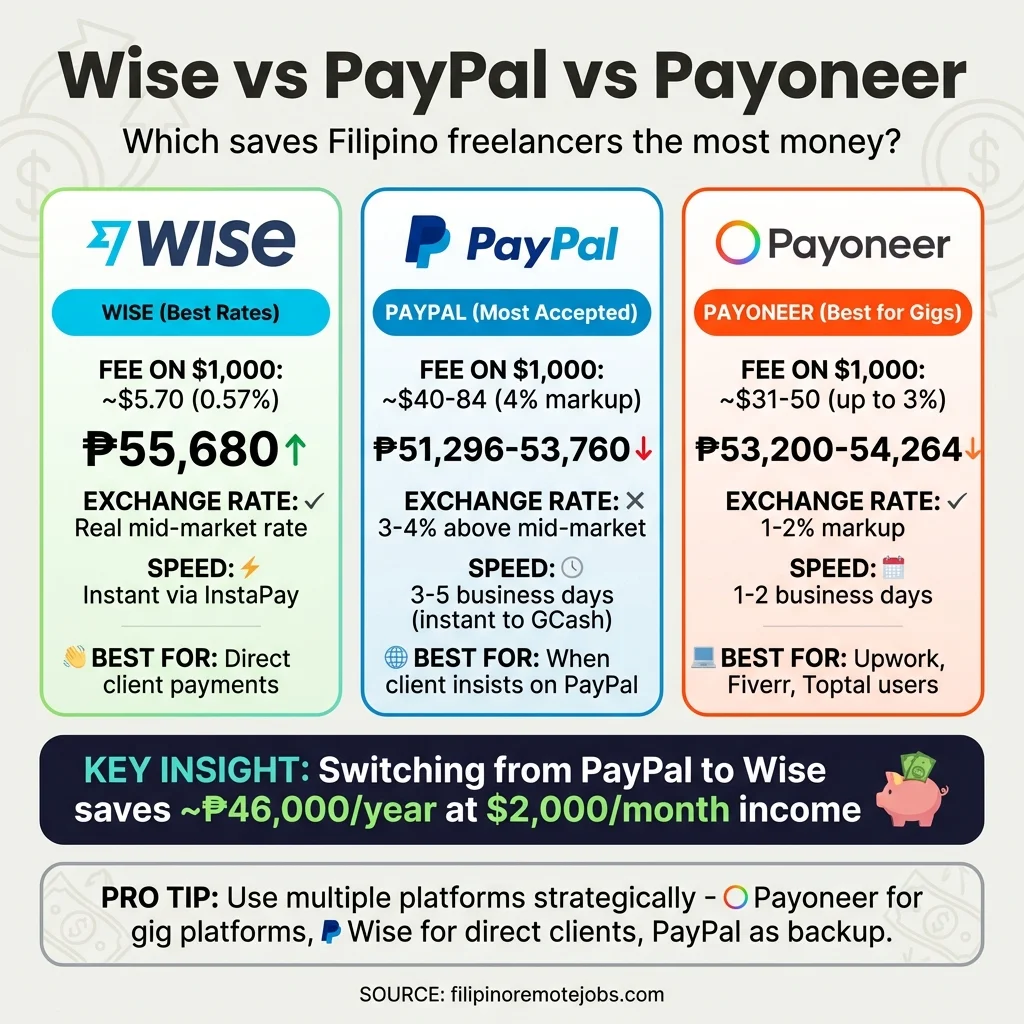

Quick reference

Save this infographic for your next payment platform decision:

Fees and rates mentioned in this article were verified in December 2025. Exchange rates fluctuate daily, and platform fees may change. Always check the latest pricing on each platform's official website before making decisions.

Get Remote Jobs in Your Inbox

Join Filipino professionals getting curated remote job opportunities delivered every week. No spam, unsubscribe anytime.

Related Topics

Share this article

About Filipino Remote Jobs Team

The Filipino Remote Jobs Team is dedicated to helping Filipino professionals find legitimate remote work opportunities with international companies. We provide career advice, job search tips, and insights to help you land your dream remote job.

Related Articles

SSS, PhilHealth & Pag-IBIG: The Complete Guide for Filipino Freelancers & Remote Workers (2026)

How to register, pay, and maximize SSS, PhilHealth, and Pag-IBIG as a Filipino freelancer. 2026 contribution tables, benefits, and pro strategies.

The Philippine BPO Industry Is Dying: An Honest Guide for Filipino Workers Who Refuse to Go Down With It

AI is replacing BPO jobs faster than expected. The data Philippine call center workers need, the roles that are safe, and your 90-day plan to pivot.

Free Certifications That Actually Help You Get Hired Remotely (Philippines 2026)

Stop collecting random certificates. These role-specific certification roadmaps show Filipino remote workers exactly which free courses to take for VA, social media, bookkeeping, e-commerce, customer support, and data roles.